This is not a typical post you’ll come across on our blog. Since one can look at SEO from various angles, today I want to see how it’s to be in investor’s shoes and tackle the aspects of online business in terms of its competitiveness as far as generation of traffic from search engines is concerned. Even though it proves to be the fundamental skill most of the times, it’s rarely subject to a due diligence check.

A few years of collaboration with venture capital funds have taught me that usually such a check covers the financial and legal areas, but not so often the business side. Such an approach means that due diligence doesn’t limit risks as well as it could, and frequently fails to reveal hidden potential of a business being audited.

Every business is multidimensional and it’s impossible for an investment team, regardless of how many members it has, to identify all risks involved. This article is supposed to help funds and investors assess actual risks associated with online traffic generation, with particular emphasis on search engine traffic. Being a part of the startup ecosystem, we should learn new things and ensure that this knowledge is shared and exchanged between startups and investors; for only thought-through investments can strengthen the market.

Speaking of search engine traffic, when to carry out a due diligence check?

As a matter of fact, I’d recommend paying attention to this aspect at all times, but there’re businesses where it’s of greatest importance – to name some examples:

- Businesses operating in the vast B2C market (especially those offering digital products)

- Ecommerce businesses

- Marketplaces

- B2B businesses basing its marketing strategy on content marketing

- Portals/Verticals rich in content.

A few examples

The importance of such an analysis may be shown on a few examples:

Ceneo.pl

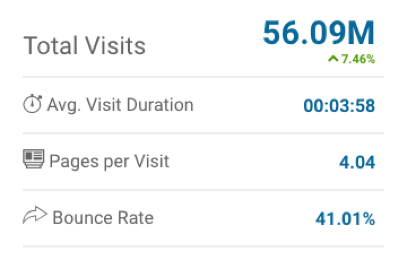

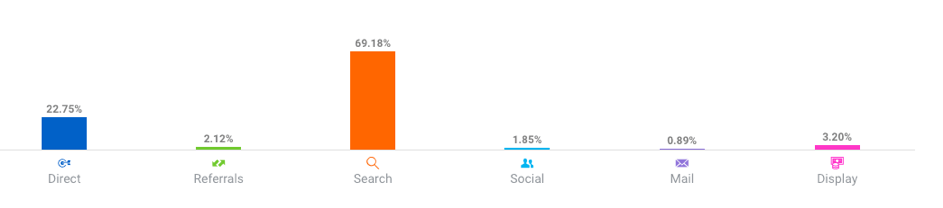

Ceneo is a well-known price comparison engine. It constitutes part of Allegro Group – a business which has been involved in certain acquisition deals over the recent years. According to SimilarWeb, Ceneo.pl currently generates over 56 million visits a month.

Source: https://www.similarweb.com/website/ceneo.pl

Taking a closer look at the website structure, you can notice that as many as 69% of said 56 million come from search engine queries.

Source: https://www.similarweb.com/website/ceneo.pl#overview

When you run a simple calculation (56 million visits * 0.69 – search engine traffic * 0.89 – organic traffic), you’ll see that SEO generates as many as 34 million visits. Approximately 20% of organic visits are brand traffic (users visit the website by typing such phrases as “Ceneo” in the search engine), thus there remain 27 million visits out of our 34 million visits – it accounts for 48% of the entire traffic on Ceneo.

It’s easy to imagine what would happen if one day Google decided to delete Ceneo from search results (Google tends to be fickle, but more about it later). From the investor’s perspective, that would be a devastating blow.

Znanylekarz.pl

Znanylekarz.pl is a website considered a synonym of Polish success of the startup industry. It’s a great product that works perfectly on numerous markets. According to Crunchbase (https://www.crunchbase.com/organization/docplanner), since 2016 the company’s acquired over 26 milion dollar in funding.

We made the identical calculation as in the case of Ceneo for Znanylekarz.pl – this website generates in Poland almost 8 million visits monthly, 71% of which originate from the search engine (97% of this traffic accounts for organic search results) and around 25% constitute brand traffic. Applying the following formula: 8*0.71*0.97*0.75 = 4.13, we’ll learn that 59% of the entire traffic on the website is based on organic search results (SEO). It’s not difficult to imagine how a possible problem with sustaining this traffic could affect company’s evaluation.

A real threat, not an imaginary problem

When analyzing this issue, it’s also worth looking at real examples from history which show that drops in visibility in the search engine in the case of businesses basing on this source of traffic actually affect their further evaluation.

Nokaut.pl

The most famous example from the Polish market of a sudden visibility drop is Nokaut.pl. This website competed in 2011 with other comparison engines on Google, but now it doesn’t correspond to even a permil of Ceneo.pl traffic as far as said source of traffic is concerned.

It’s a result of adopting an unsound SEO strategy which consists in sourcing poor-quality links on a mass scale (from systems of link exchange), which – as you probably know – is contrary to Google search engine guidelines. Therefore, Nokaut.pl got penalized by having been depressed in search results drastically. Nokaut.pl lost 80% of its traffic overnight.

In addition, this was a time when Nokaut was before IPO (Initial Public Offering). The company did debut, but the stock exchange noted a considerable decline.

Source: https://www.bankier.pl/inwestowanie/profile/quote.html?symbol=HUBSTYLE

The company’s value over two subsequent years decreased fivefold; worth 7,829,100 dollars at the beginning of its stock exchange adventure, it was ultimately sold last year to SARE SA for 469,746 dollars. Said penalty wasn’t obviously the only reason for such a turn of events, though it definitely made the website suffer a great deal.

Expedia

It’s one of the biggest travel websites worldwide. In January 2014, Expedia also got penalized by Google, which led to a substantial drop in visibility and search engine traffic – the website lost around 700 thousand visits daily, meaning 21 million visits monthly! As a result, Expedia’s stocks lost over 4.5% of their value.

The market cap of the company was then 4.5 billion dollars, which means that it lost more than 200 million dollars in value overnight. Nonetheless, Expedia survived that crisis (it generated traffic from other sources as well), regained its visibility on Google and is on the rise once again.

There’re plenty of examples, but three aforementioned three ones are enough to learn how changes introduced by Google may affect company’s value, or even all of its operations.

Market size – case study

Once you’ve learned how to assess the importance of SEO-wise business analysis, a case study would be a good idea.

The first thing to do is to identify market size in the context of a product offered by a given business. To this end, use keywords and their search potential, which helps establish how many times an individual keyword is typed in the search engine over a single month.

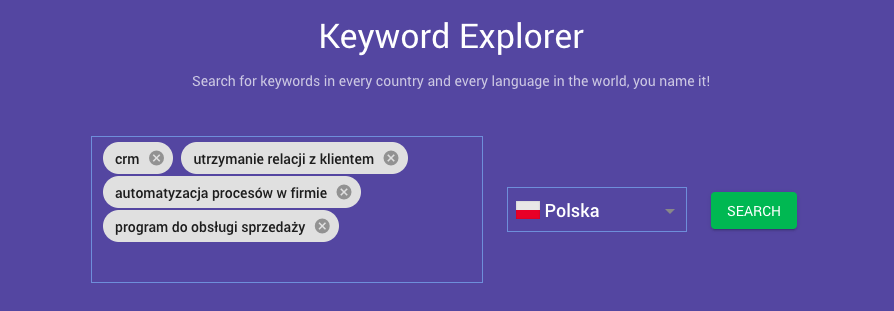

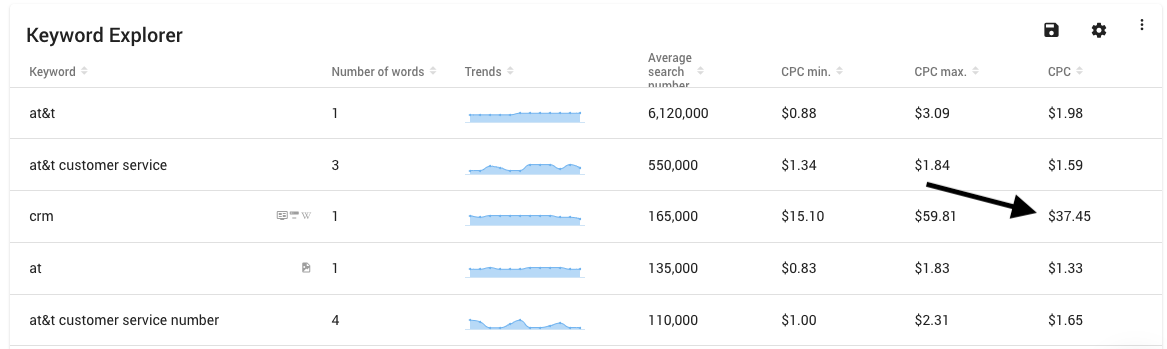

For illustration, we’re going to discuss a B2B company that wants to sell its CRM system. Let’s go to Senuto’s Keyword Explorer*; not only will it let us check the number of searches for selected keywords, it’ll also suggest additional keywords searched for by other users in relation to our topic or theme.

*Senuto Keyword Explorer is available only for the analysis of Polish domains.

Source: https://new.senuto.com/keywords-explorer

I provided core keywords associated with this type of software and chose Poland (Polish market), though for the purpose of this study I could’ve chosen any other market.

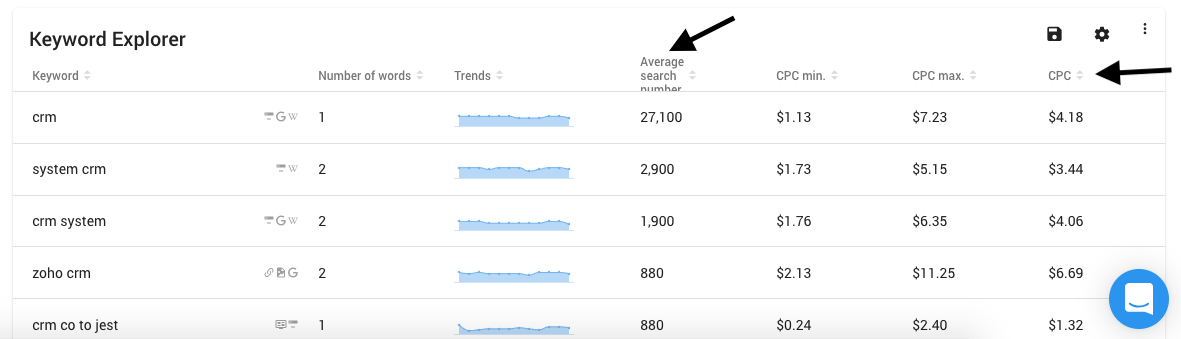

Two things attract my attention after getting the results:

- Average search number – this tells us how many times on average a given keyword is searched. In this case, “CRM” is typed in the search engine 27,100 times monthly. Quite a big number for software. To compare:

- CPC – it’s the first measure which helps define the competitiveness of the selected market. This metric tells us how much it ought to be paid in Google Ads, give or take, for a click in a given keyword. $4.18 that visits to the website by users would cost approximately $418.

Assuming that 5% of users convert to trial, and every trial costs $81,37, and assuming that conversion from trial to paid version equals 4%, every paying user will cost $81,37*20, i.e. $1627,4. If an LTV of the product is known, it takes simple math to establish if it’s profitable to invest in such a channel. We may conclude that $5 in this case is a pretty high price, bearing in mind that Poland is one of the less expensive markets.

Let’s analyze the same keyword for the US market:

Every click will cost $37.45. Doing the same math as for the Polish market, it turns out that every paying user will cost $14,980 in Google Ads! Naturally, these are very simplified calculations, though the reality won’t differ much so they can be a great point of reference.

This way, I got a total of 772 suggested keywords which translate into 57,300 searches monthly in overall – it’s total demand for this type of product in Poland via the search engine. Therefore, assuming it’s possible to get 10% of said searches (which is a great result):

- This channel will generate 5,730 visits monthly, meaning 136,250 visits in 24 months

- A trial-version conversion rate of 5% will mean 286 new trials monthly, meaning 6,848 trials in 24 months

- A paid-version conversion rate of 4% will mean 11 new clients monthly and 265 new clients in 24 months.

These figures assume very efficient sourcing of traffic from said channel, which would be extremely difficult taking into account competition (considerably high CPC).

Supply of the product

Regardless of how strong demand for a given product is, one needs to answer another question: how big is supply? In fact, every industry has its own articles and studies regarding the size of a market and the number of entities operating in it. However, access to them tends to be difficult. Yet again Google comes to the rescue. Here, I’d rather advise to employ this method only at the first step of verification and further to use professional market analyses based on financial data.

Supply of a given product may be determined through a number of documents indexed in the search engine for a selected keyword. For instance, type “program księgowy” (which means “accounting software”) in Google.pl and you’ll see over 20 million documents indexed which were classified under this phrase.

The keyword in question gets searched roughly 1,000 times a month, which means that 203 thousand results on Google account for every single search (it’s an abstract figure for comparison only). Now let’s compare it with a query for e.g. “automatyzacja marketingu” (which translates into “marketing automation”) that has 140 searches and 456,000 results. In this case, 32 thousand results on Google account for every single search.

The foregoing informs us about the following:

- There’s substantial supply of accounting software; perhaps the market is full of similar solutions

- High supply combined with quite low demand and considerable CPC make it necessary for the product to prove extremely marketable, efficient in terms of user conversion, but also to be characterized by a high LTV in order to be successful on the market.

Is the business going to grow?

A VC investment takes 8–10 years on average. A mere assessment of the current state of affairs in this context means little. We need to be able to look into the future and judge in retrospect whether the investment has proven reasonable. To do that, we can employ a few analytic tools:

Google Trends

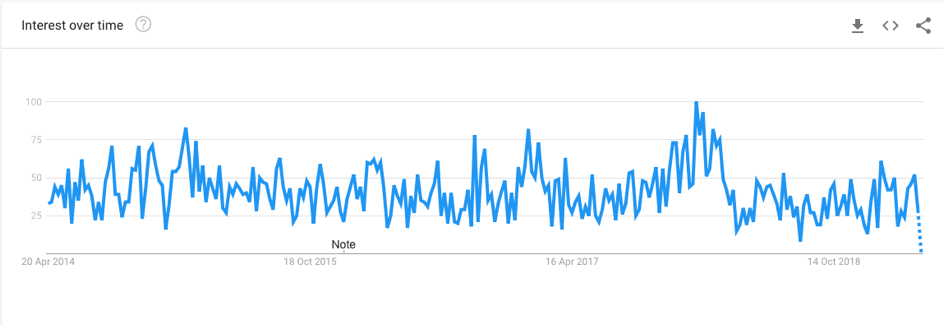

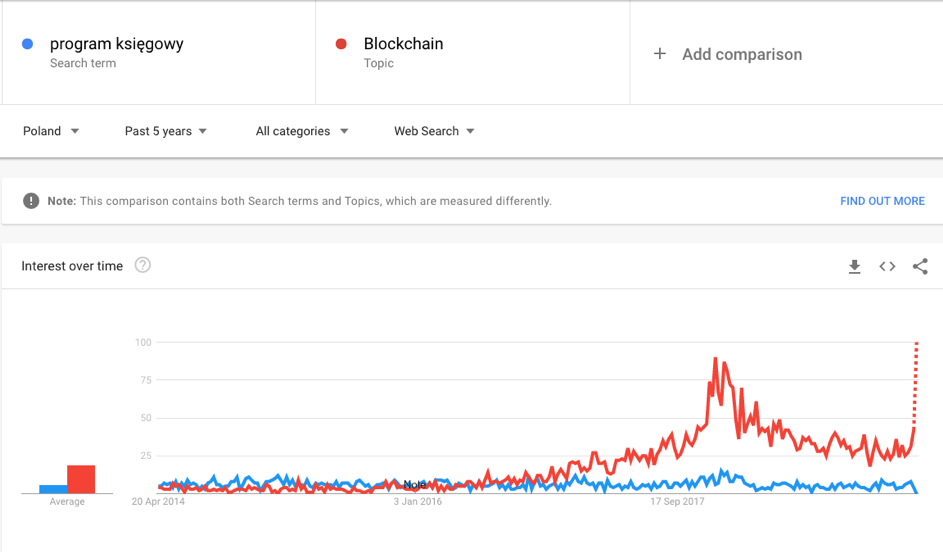

It’s a tool to study trends. You can establish whether an interest in a product or service increases or decreases over time. Let’s take another look at the example of “programy księgowe” (“accounting software”).

Source: https://trends.google.pl/trends/explore?date=today%205-y&geo=PL&q=program%20ksi%C4%99gowy

We can see that since 2014 an interest in this category of products hasn’t been growing and has even been declining. Don’t expect then everyone to need accounting software suddenly. Just compare it with, for instance, the keyword “blockchain” to see how much of a gap there is between these two topics.

This obviously doesn’t cripple the business, though it leads to a few crucial conclusions:

- No new clients get attracted to the market – their number is rather constant, so companies need to compete for a clientele with others

- The foregoing is usually associated with greater marketing expenditure when compared to a growing market, where the number of new clients normally continues to rise.

Senuto

Verification involving comparison of a business and the industry leader also partly answers the question how much a given business can still grow when it comes to traffic from search results. To identify that, Senuto may be of help, specifically its module called Visibility Analysis.

Let’s assume that I’d like to invest in Allani.pl, a fashion marketplace. A comparison with this industry leader will tell me how much traffic can be generated in the segment.

To this end, I used the Ranking report which classifies websites into 403 thematic categories and calculates expected search engine traffic for each of them. Based on the Visibility parameter, it’s possible to define differences in estimated monthly traffic between the websites selected. First of all, this notifies me about the rank of my potential investment in the industry, and second of all, by comparison with the leader, I know the market size.

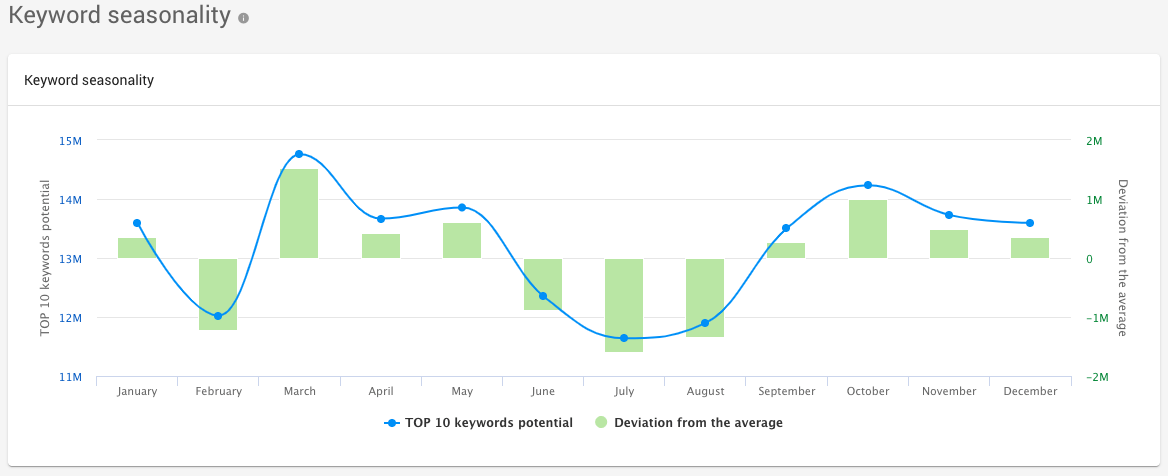

Business seasonality

It’s important to learn the seasonality of a business, online or otherwise. If you want to evaluate a financial model, you need to know whether a product you offer is subject to seasonality. Most of the times it’s obvious, though sometimes things are more complex.

Analyzing Allani.pl, let’s assume that it’s visible in the search engine only for keywords related to summer dresses. We can expect that if its visibility doesn’t change, traffic will be generated mostly in summer instead of the entire year, which completely alters our approach to the evaluation of this business model.

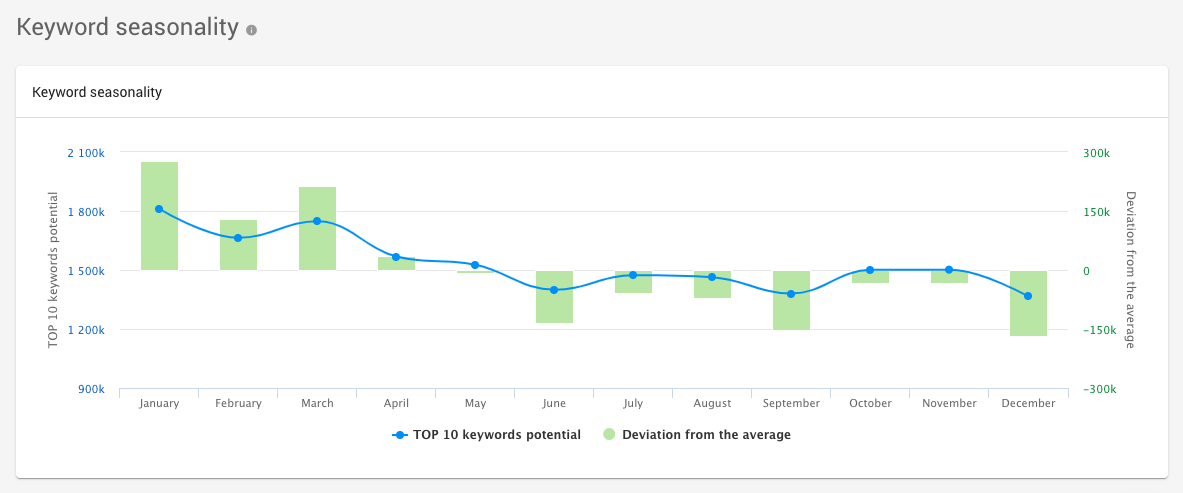

So, when you know keywords for which a website is ranked, you can determine its seasonality, meaning a number of searches of keywords in individual months.

Source: https://new.senuto.com/visibility-analysis?domain=allani.pl&fetch_mode=subdomain

Allani.pl is presently visible in Top10 for 156,783 keywords. This means that by entering as many keywords, Allani.pl is going to be ranked between 1 and 10. Basing on such keywords, website’s seasonality is established. It’s easy to conclude then that:

- The website may expect greater traffic in March (spring collection) and October (fall collection).

- Before the summer season, the website notes a slight increase (in May) which means an interest in summer collection, though it may also suggest that it doesn’t have.

The number 13.9 million marked on the screenshot means that all the keywords for which Allani.pl is currently positioned (157,783) were searched 13.9 million times in overall in April. In this case, deviations range from 8 to 14 million, which suggests that in some months the website can generate half the traffic of the best months. It certainly substantially affects its traffic and revenues.

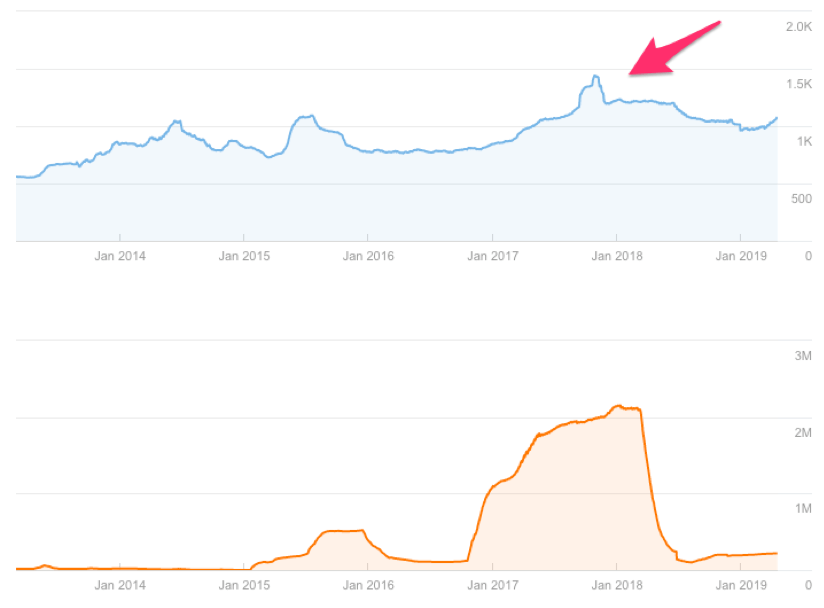

Let’s discuss another, more extreme case. Extradom.pl sells ready-to-execute house designs.

At first glance, it’s evident that what counts for this business are the first couple of months. Usually, when you decide to build a house, you need to buy a design already at the beginning of the year (by May at the latest, as data suggest), so subsequent months are much less profitable, but that’s natural. This knowledge allows for better understanding of the model. If you’re not an expert in an industry (for example in the house designing one), you can use such data to verify the correctness of the assumptions as to the growth model.

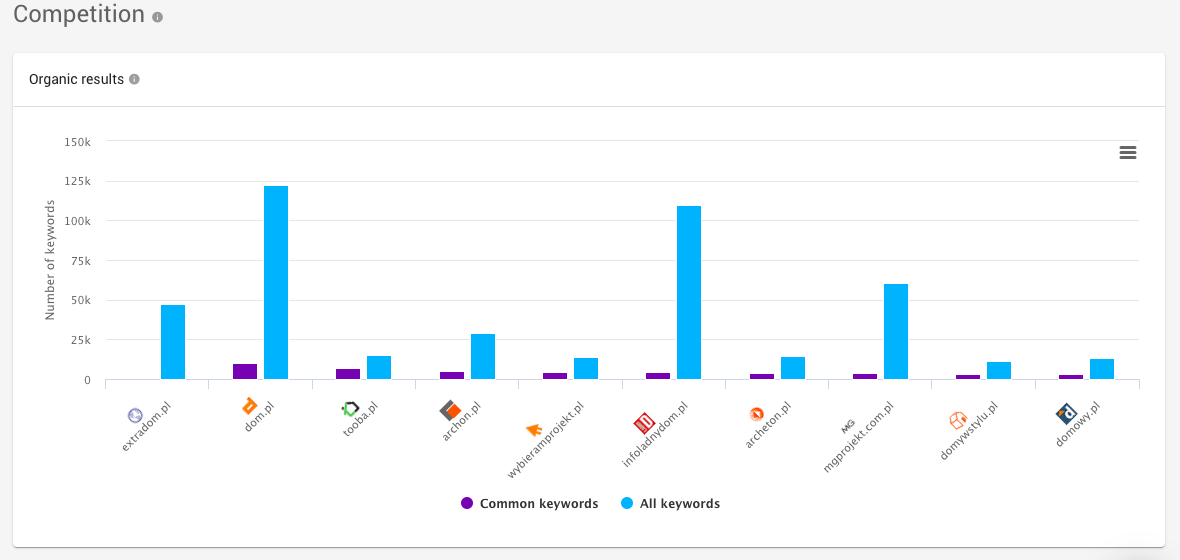

Neighborhood analysis

Even though probably everyone’s able to establish who their major competitors are, this doesn’t work for search engines. In the search engine, your competitor is a site that neighbors with your website in search results. In practice, it’s not always your real business competition. Here, verification will help us check whether we compete for a user with more businesses than we think.

For this purpose, I’ll use Senuto again and identify which websites compete with Extradom.pl.

Source: https://new.senuto.com/visibility-analysis?domain=extradom.pl&fetch_mode=subdomain

This screenshot, from the left, illustrates competitors of Extradom.pl that neighbor with said website in search results most often. In other words, these are the websites with which Extradom.pl most frequently competes for users. Here, business competition seems to coincide with search engine competition, but let’s look at a different example.

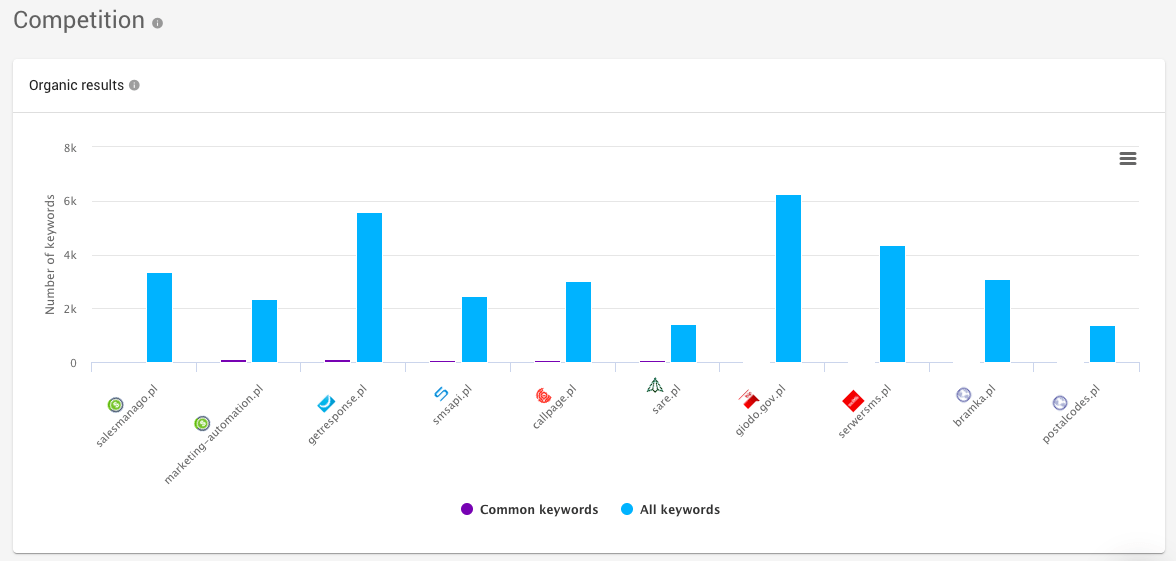

Let’s analyze Salesmanago.pl, one of the leaders in marketing automation.

It’s evident that the competitors include not-so-obvious sites like Smsapi.pl, which competes with Salesmanago.pl only in one area.

Red flags

Once you’re sure that SEO is important for your potential investment and a loss of traffic might thwart your development plans, it’s worth going through the website and trying to identify any red flags. In this case, the risk is clear as day.

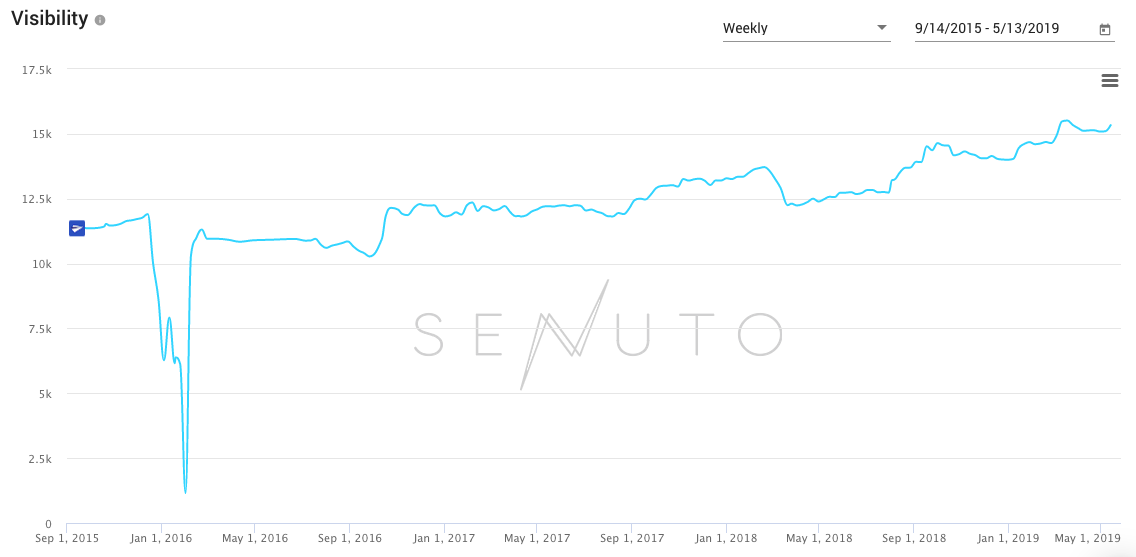

Drastic changes in visibility in the past

It can prove useful to check whether or not the website noted considerable drops/increases in the context of visibility in search results. Let’s have a peek at Senuto’s Visibility Analysis that’s been accumulating historical data since 2015.

Another example – Fru.pl:

It can’t be hidden that the website noted a vast drop at the beginning of 2016. In this case, it was an effect of a poor site migration. However, it’s good to know how such a company’s going to protect itself against similar situations in the future.

In this case, it was easy to remove the cause so visibility got restored. Nevertheless, sometimes such a drop is a result of a penalty imposed by the search engine on the website. If this happened to your site in the past, you might want to check it out as history likes to repeat itself.

Massive increases in links

One of the most essential algorithm-based elements of a search engine are links to a website. In other words, the more links lead to your website, the higher it should get ranked. Naturally, it’s a great oversimplification; what’s most important here is the method of their acquisition. There’re a few things that need to be red-flagged:

- Too extensive link increase over a short period of time – this kind of increase looks extremely unnatural from the search engine’s perspective and may lead to a penalty

- Links from sources of poor quality – it happens that SEO experts take shortcuts and source links from places of ill repute in the search engine, to say the least; the risk here is similar to the one involved in the aforementioned case

- Bad linking profile as far as anchor text is concerned – details aside, it’s crucial for a linking profile to resemble a random profile as much as possible. A profile that users could create by adding links to the website on their own. If HTML anchors include too many keywords of interest, a penalty is always a possibility.

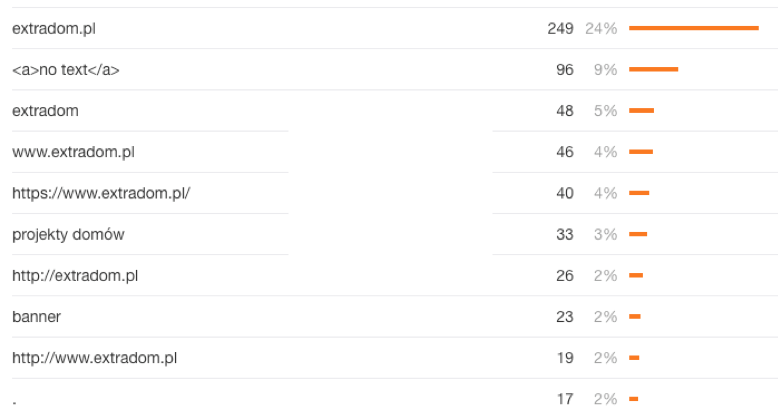

To examine this, try Ahrefs.com. Let’s re-analyze Extradom.pl.

An increase in sites from which this particular website sourced links looks pretty natural – it’s been on the slight increase since 2014. However, at the beginning of the year, it lost a huge number of linking pages, which means that it lost links from sites whose multiple pages linked to this website. Most probably it’s nothing to be concerned about, yet it’s still worth having a look at.

When it comes to anchors used, it looks as follows:

It seems quite natural, Google shouldn’t be suspicious.

The tool allows you also to carefully examine the URLs and reveal all the links. Look through them and determine their most frequent sources.

Threats to the SEO industry

The SEO industry, like every industry, faces various threats. Let’s discuss them individually and holistically.

- Google tends to be fickle, as evidenced clearly by the example of Nokaut.pl. Thus, it’s dangerous to base your entire business on organic traffic. However, should a business be primarily based on this type of traffic, it’s useful to scrutinize an SEO strategy adopted.

- Google’s shown its insatiable hunger many times, having brought to life for example the following:

- Google Flights – a flight search engine operating since 2011 which makes it easier to plan trips and buy airplane tickets for flights offered by over 300 airlines and tour operators. It’s a direct competitor of such companies as Expedia, Kayak, Fly4Free, and Skyscanner

- Google Shopping – an ecommerce search engine or simply a paid directory of products presenting goods corresponding to phrases typed in the search engine. It’s possible competition of other online search engines like Ceneo.pl

- Google Trips – it’s a digital travel guide which is also available online. It’s an area where you can save your flight or hotel bookings and places to visit or even to make a trip plan.

These solutions are supposed to force standalone ventures, like flight search engines, out of business. When Google introduces its product, it has a relatively easy job to beat the competition and push them down in search results – the competition Google used to feed earlier.

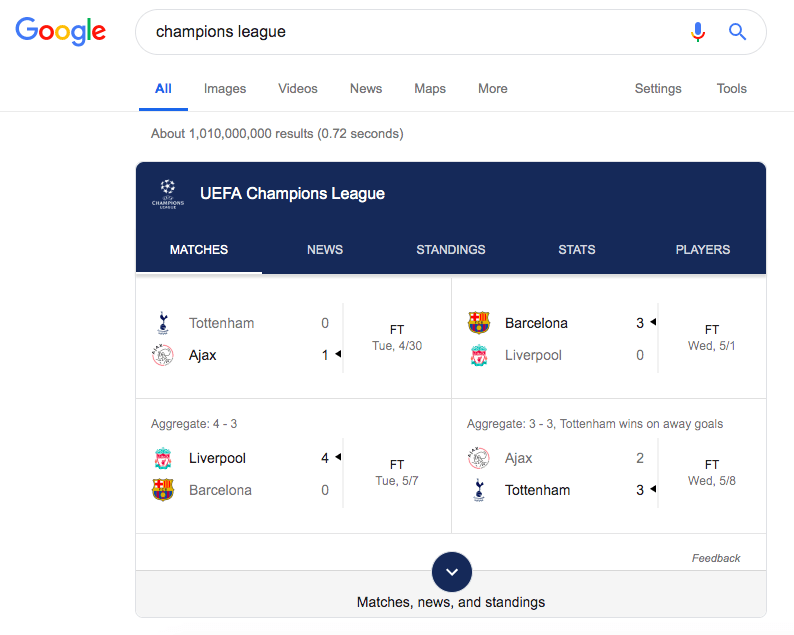

- Google doesn’t want to share

The search engine’s not interested in directing users to external sites. Its purpose is to give the answer as fast as possible, especially in the times of interface shifts. Therefore, after typing in certain keywords that used to generate considerable traffic, now the user will see something like that:

There’s no need for the user to leave Google. It’ll hit predominantly those websites which have knowledge easy to classify, various databases above all. Recently I’ve been often saying that ‘when you don’t grow, you shrink’, and in the context of such changes it seems very true.

At this point, it ought to be said that SEO has died multiple times and always been brought back to life, and in the investment perspective of a few years to come there’s nothing to worry about. Well-planned well-run businesses will still be able to capitalize on organic traffic for some years.

An SEO specialist in the due diligence process

The foregoing guide should let you make a basic analysis to get an answer to the fundamental question whether or not to further engage in the investment process. If you decide to proceed, it’d be good to use some advice of an SEO expert who will do the following:

- Carry out a detailed SEO audit of your website.

- Investigate your SEO strategy; you should ask for it.

- Carefully study the market.

A few thousand dollars spent now can certainly protect you against multiple unsound investment decisions later.

Conclusions

Although I zoomed in on a few ways of verifying a business prior to investment, there’re a lot more. That’s why it’s also worth scrutinizing this topic and advisable to pay more attention to it.

Sometimes, SEO specialists are placed very low in the organizational structure, even though 80% of the business hinges upon traffic from the search engine. The management frequently fail to notice the importance of that. I do hope that this article will make more people appreciate SEO and see it for what it really is – one of the most vital constituent of the entire business.

Damian Sałkowski

Damian Sałkowski